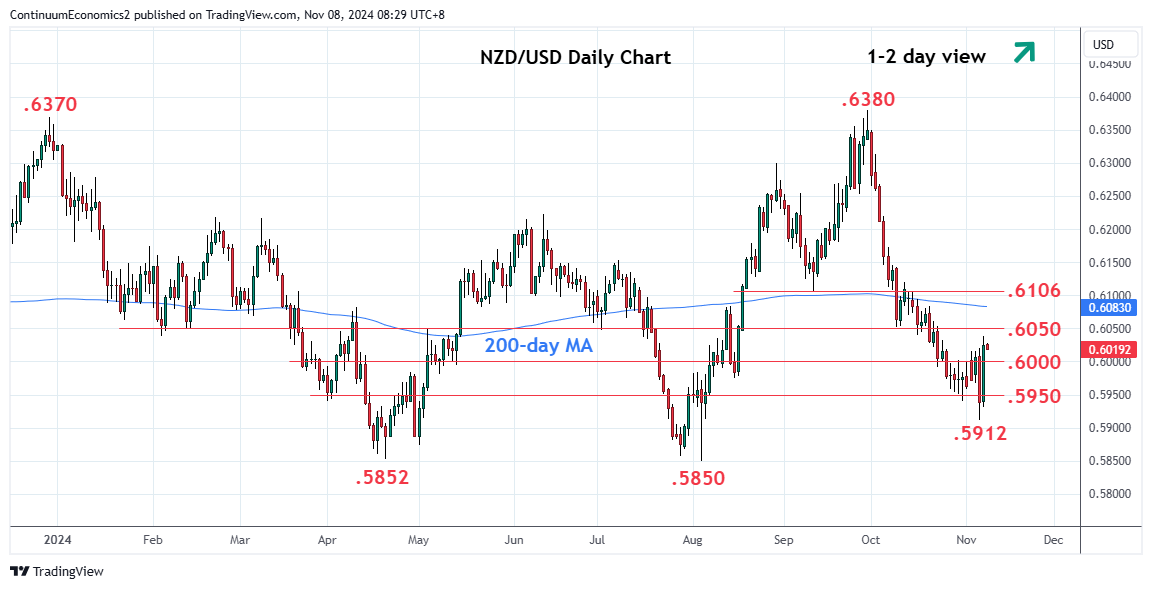

Consolidatione below the .6000 level gave way to break higher above .6021 to reverse the mid-week losses

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | .6145 | * | 50% Sep/Nov fall | S1 | .6000/80 | * | figure, congestion | |

| R3 | .6100/06 | * | congestion, Sep low | S2 | .5950 | * | congestion | |

| R2 | .6090 | * | 38.2% Sep/Nov fall | S3 | .5912 | ** | 6 Nov low | |

| R1 | .6050/52 | ** | congestion, 9 Oct low | S4 | .5900 | * | congestion |

Asterisk denotes strength of level

00:40 GMT - Consolidatione below the .6000 level gave way to break higher above .6021 to reverse the mid-week losses and confirm a low in place at the .5912 low. Further choppy trade can be expected but the daily studies have turn positive and suggest room to retrace steep fall from the September high. Nearby see room to strong resistance at the .6050/52 congestion. Break here will open up stronger gains to the .6090, 38.2% Fibonacci retracement, and .6100/06 area. Meanwhile, support is raised to the .6000/.5980 congestion area which is expected to underpin and sustain gains from the .5912 low.