Chartbook: Chart EUR/GBP: Fresh 2024 year lows - studies remain under pressure

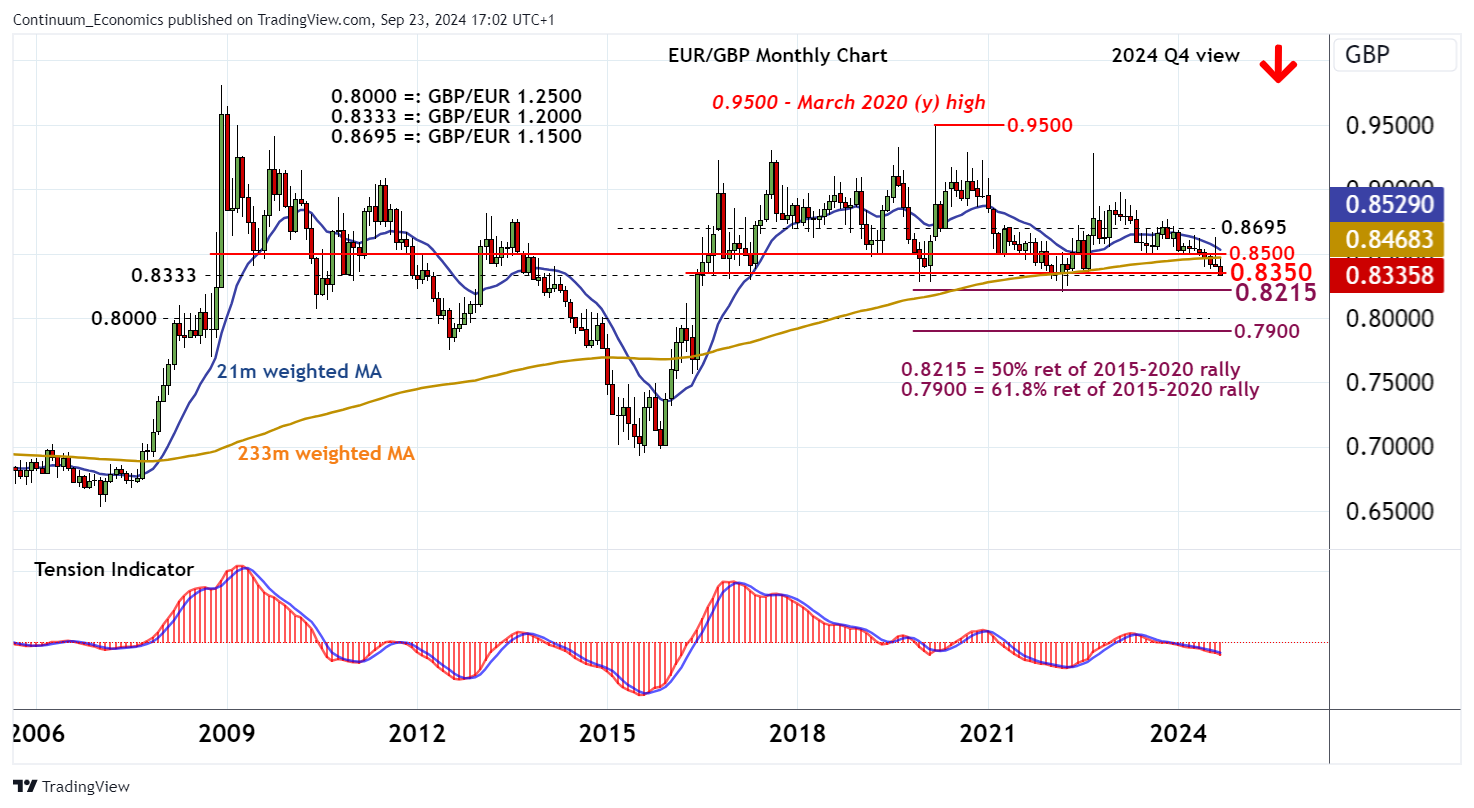

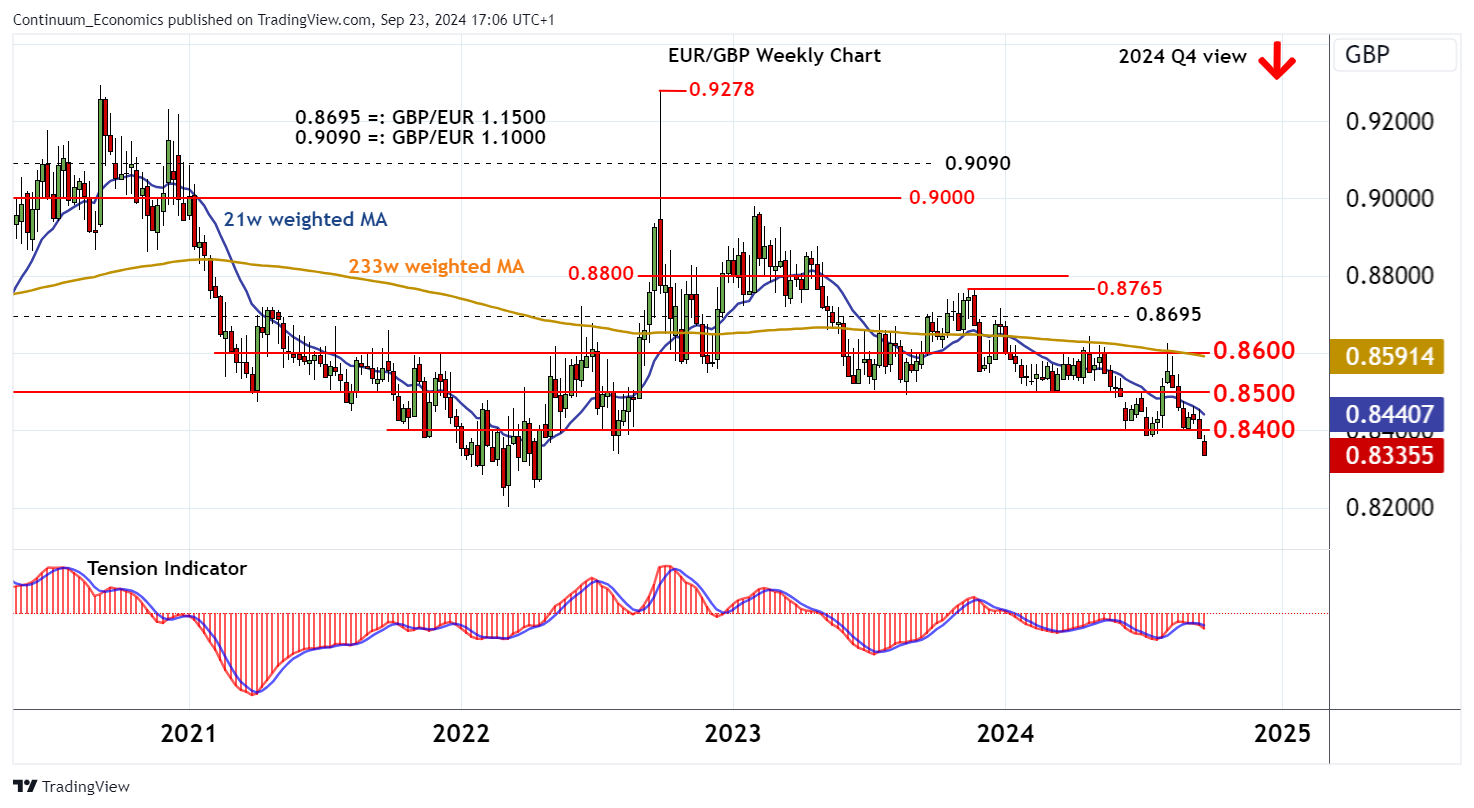

The anticipated (choppy) drift lower is posting fresh 2024 year lows around congestion support at 0.8350 and 0.8333, (GBP/EUR 1.2000)

The anticipated (choppy) drift lower is posting fresh 2024 year lows around congestion support at 0.8350 and 0.8333, (GBP/EUR 1.2000).

Monthly stochastics and the monthly Tension Indicator remain negative, highlighting a bearish tone and room for still deeper losses into the coming weeks.

A close below 0.8333/50 will add fresh weight to already bearish price action and extend September 2022 losses towards critical support at the 0.8215 multi-year Fibonacci retracement.

However, monthly stochastics are flattening in oversold areas, suggesting any initial tests could give way to consolidation, before bearish longer-term charts prompt a break.

Meanwhile, resistance is lowered to congestion around 0.8400 and extends to congestion at 0.8500.

An unexpected close above this area would turn sentiment neutral and prompt fresh consolidation.

However, a further close above 0.8600, if seen, would turn price action positive and put focus back on 0.8695, (GBP/EUR 1.1500). Just higher is critical resistance at the 0.8765 monthly high of 28 December, but this area should cap any unexpected tests.