Published: 2024-11-14T08:53:37.000Z

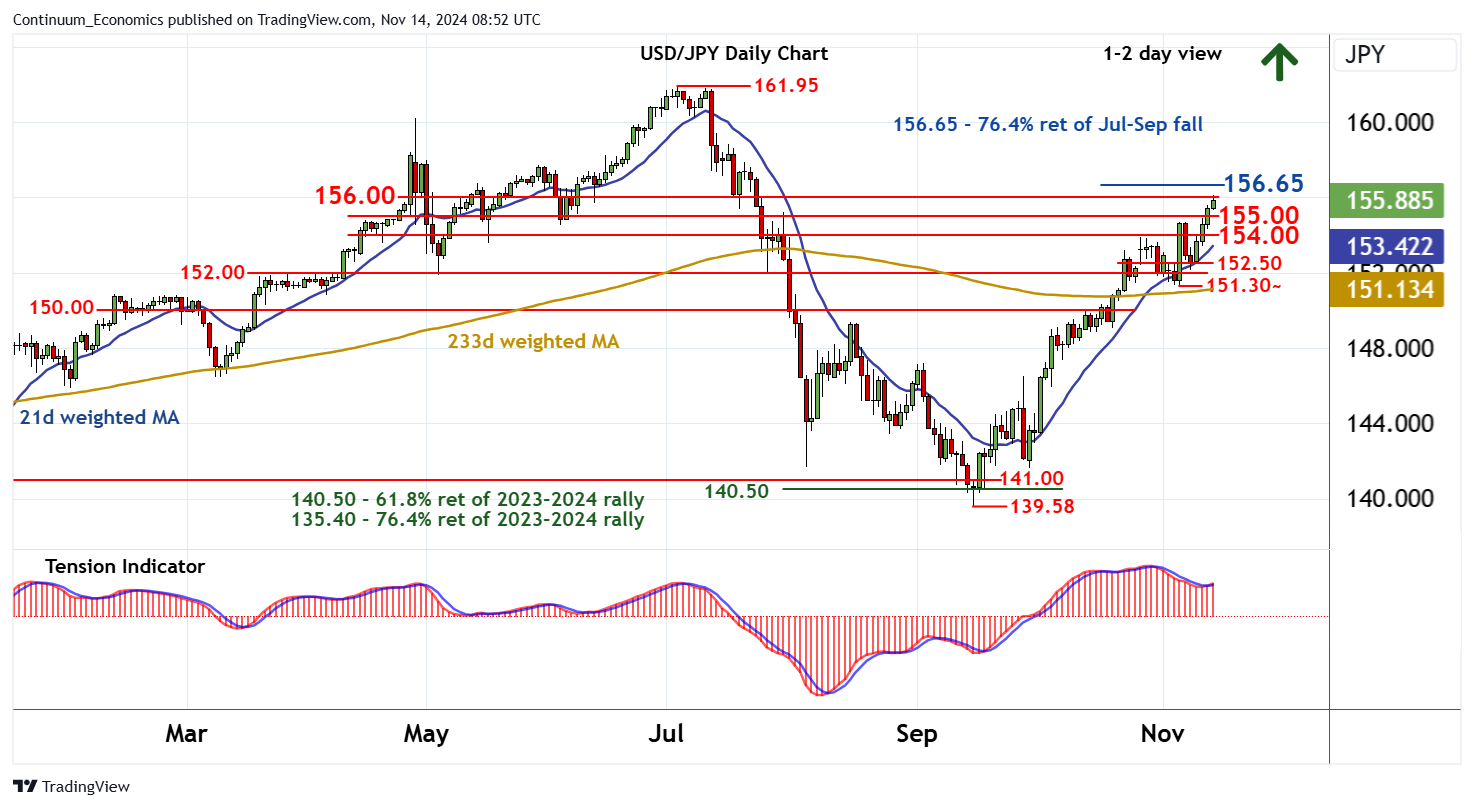

Chart USD/JPY Update: Strong resistance at the 156.65 Fibonacci retracement

Senior Technical Strategist

3

The anticipated break above 155.00 has reached congestion resistance at 156.00

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 157.86 | 19 Jul high | S1 | 155.00 | * | congestion | ||

| R3 | 157.00 | * | break level | S2 | 154.00 | * | break level | |

| R2 | 156.65 | ** | 76.4% ret of Jul-Sep fall | S3 | 152.50 | * | break level | |

| R1 | 156.00 | * | congestion | S4 | 152.00 | ** | break level |

Asterisk denotes strength of level

08:40 GMT - The anticipated break above 155.00 has reached congestion resistance at 156.00, where flattening overbought intraday studies are prompting short-term reactions. Daily readings continue to improve, highlighting room for a break above here and continuation of September gains towards the 156.65 Fibonacci retracement. But flat overbought weekly stochastics could prompt profit-taking/consolidation around here, before the positive weekly Tension Indicator extends gains still further. Meanwhile, a close below congestion support at 155.00 would turn sentiment neutral. But a further break below 154.00 would add weight to price action and prompt a pullback towards 152.50.