View:

February 20, 2025

Bank Indonesia Policy Rreview: Rate Pause As BI Steadies IDR

February 20, 2025 1:25 AM UTC

In line with our view Bank Indonesia kept its policy rate steady at 5.75% in its February 18-19 meeting after last month’s surprise cut. The weakening rupiah and external uncertainties reman critical factors influencing the rate decision. The central bank is likely to assess the impact of its Janu

February 19, 2025

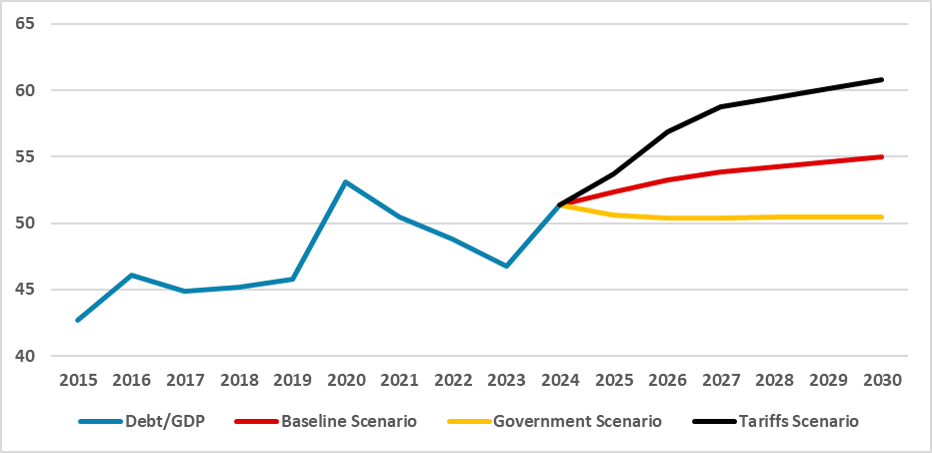

Mexico: Tariffs and Growth Issues Could Impose Fiscal Difficulties

February 19, 2025 10:20 PM UTC

Mexico aims for fiscal consolidation in 2025, relying on revenue growth while freezing most expenditures. However, weak growth could undermine this strategy. Authorities expect 2–3% GDP growth, but our forecast is 1.6%, with a recession risk. A less integrated U.S.-Mexico trade relationship, parti

FX Daily Strategy: Asia, February 20th

February 19, 2025 10:00 PM UTC

Little impact likely from Australian employment data…

…but AUD still has upside potential

JPY continues to edge higher with CHF/JPY looking particularly vulnerable

GBP strength bolstered by data short term, but little further upside scope

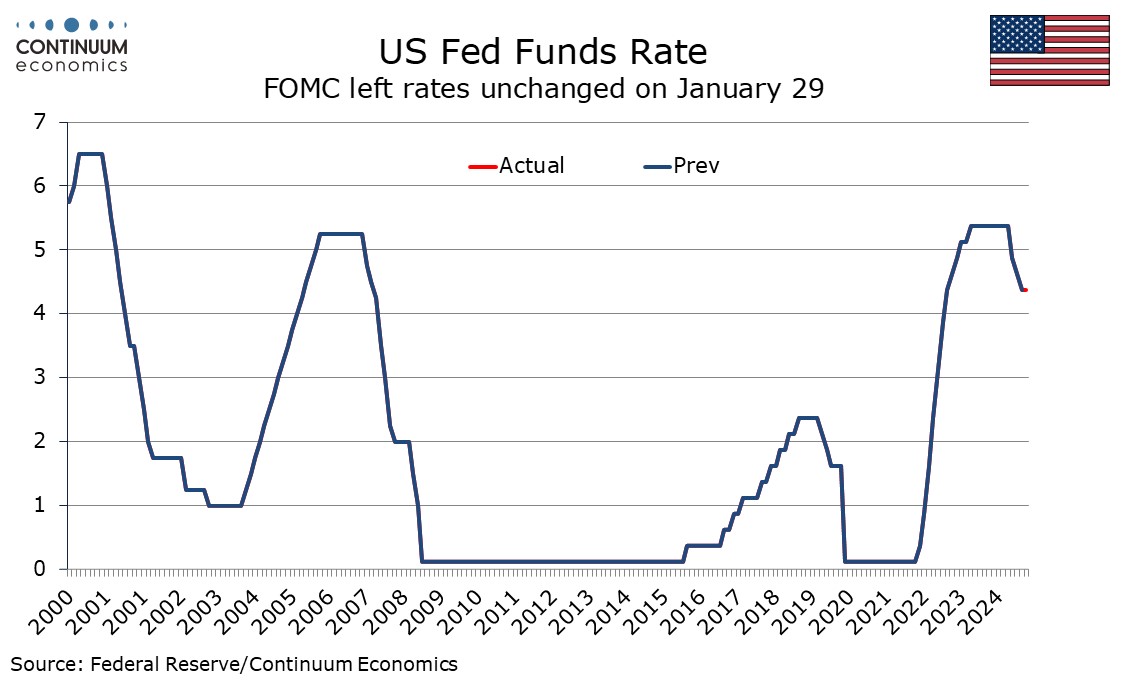

FOMC Minutes from January 29 - No rush to ease, but not hawkish

February 19, 2025 7:59 PM UTC

FOMC minutes from January 29 showed agreement to hold policy steady, and that further progress was needed before additional policy adjustments were made. High uncertainty was seen as making a careful approach appropriate, but the minutes contained few shocks, in a market that appeared to be braced f

FX Daily Strategy: APAC, February 20th

February 19, 2025 3:40 PM UTC

Little impact likely from Australian employment data…

…but AUD still has upside potential

JPY continues to edge higher with CHF/JPY looking particularly vulnerable

GBP strength bolstered by data short term, but little further upside scope

U.S. January Housing Starts and Permits - Stable underlying picture but with downside risk

February 19, 2025 1:45 PM UTC

January housing starts have seen a steep 9.8% decline to 1366k but the outcome is only modestly below expectations and may be weather-related. Permits are virtually unchanged, up by 0.1% to 1483k, suggesting a stable underlying picture, but there may be downside risks going forward.

U.S. 25% Tariff for Cars, Pharma and Semiconductors?

February 19, 2025 1:40 PM UTC

· Tariff reality in the spring and summer will likely be both tariff threats to negotiate trade deals and permanently higher tariffs in certain products and reciprocally to raise revenue for the U.S. government – along Peter Navarro guidance to Trump. The macro effects of this cou

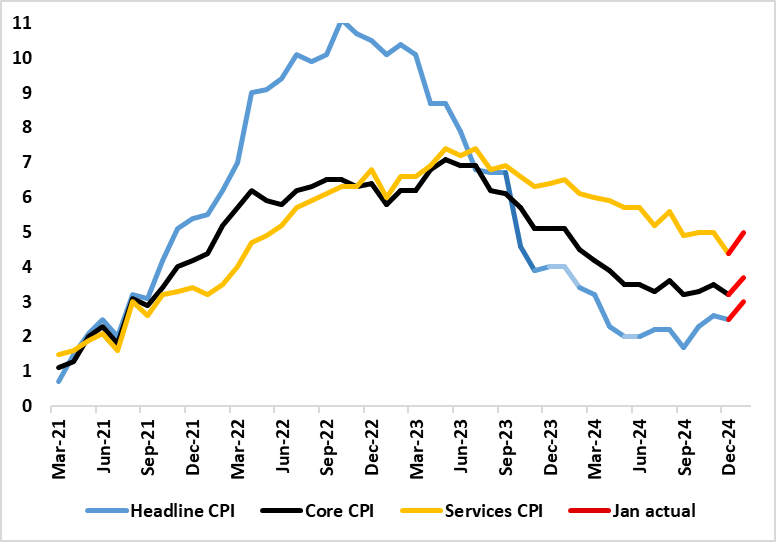

UK CPI Review: Inflation Jumps and Broadly So But Still Some Promising Wage Signs?

February 19, 2025 7:44 AM UTC

January’s CPI numbers showed a marked bounce back up, and with the 0.5 ppt rise taking it to a 10-month high of 3.0%, this being above consensus and BoE thinking. Notably services jumped from 4.4% to 5.0%, actually below expectations, having been driven higher by a swing in airfares and the rise

Asia Summary and Highlights 19 February

February 19, 2025 5:32 AM UTC

The RBNZ cut by 50bps as expected

BOJ's policy board member Takata says must hike rate more if economy moves in line with BOJ forecasts

Trump says U.S. may impose a 25% tariff on imported automobiles, pharmaceuticals and semiconductor chips by April 2